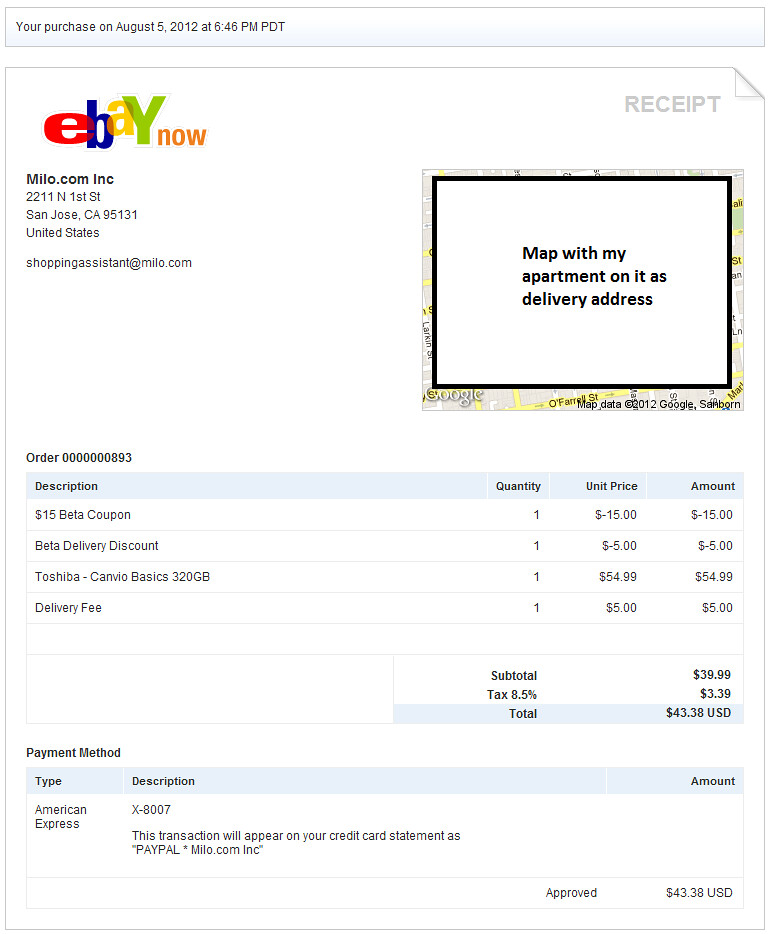

There is an eBay Invoice fee - for most categories of items you will be charged 12,55% of the sale price + an additional $0.30 per sale. Note that the eBay Invoice Number will be assigned automatically - the customer will be able to use it to refer to the transaction in your further communication and contact the eBay support over the purchase in case there are any issues by telling them the number they receive in their inbox.Įvery business and independent seller should know eBay will also send them an eBay Monthly Invoice - this document will detail the selling activity over the last thirty days to let you reconcile your financial records with the transactions online. It is possible to add remarks or comments if there are any details you have to clarify before the payment is made.

Financial records useful for filing tax - if you represent a large company making dozens and hundreds of sales every year, you will have to submit the details of these transactions to the IRS.

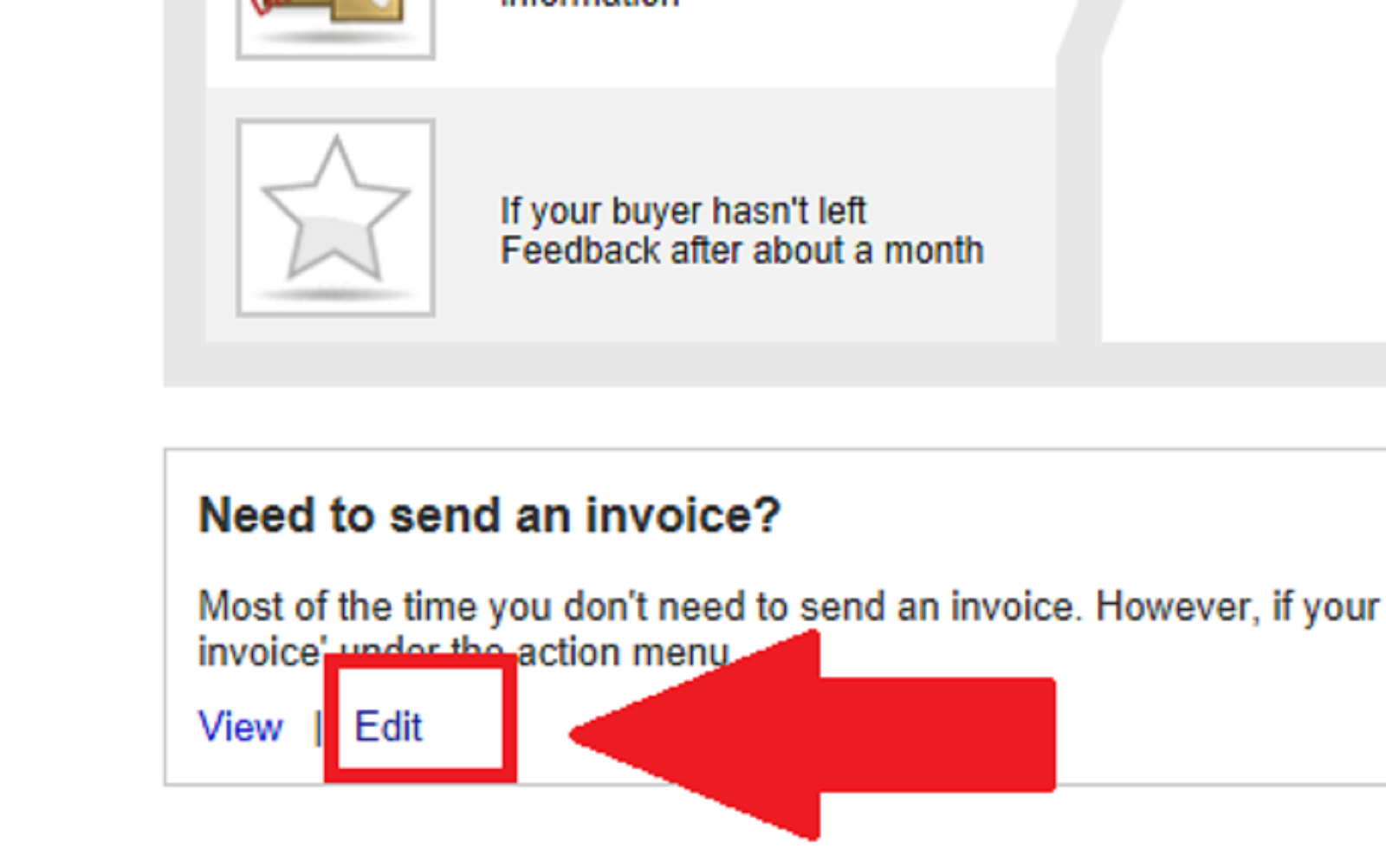

Proper bookkeeping - using the website, you will keep track of all online sales you have accomplished.There are several reasons to prepare an eBay Seller Invoice: A seller should create and send an eBay Invoice - an itemized list of goods sold and purchased on the website - after the customer wins an auction for the item or pays a required amount confirming their intention to buy the goods in question.

0 kommentar(er)

0 kommentar(er)